By Yamikani Jimusole, Gemologist

The global gold market, valued at USD 291.68 billion in 2024, is projected to grow from USD 308.32 billion in 2025 to USD 457.90 billion by 2032, with a CAGR of 5.80%.

Gold is prized for its luster, conductivity, and resistance to tarnish, making it essential in jewellery, electronics, dentistry, and as an investment hedge. With the Asia Pacific region leading demand, Malawi’s untapped gold reserves present a significant opportunity.

Malawi’s gold sector holds significant potential. As part of the Agriculture, Tourism, and Mining (ATM) Strategy, boosting gold production and exports could drive economic growth, create jobs, and enhance revenue. Transparency will be key to unlocking this resource, aligning with Malawi’s 2063 Vision. With the new government focusing on local mineral processing and aligning with the African Mining Vision (AMV), the future looks bright.

But how can the country capitalize on this growing market?

BOOST SUPPORT FOR ASMs

It is no secret that Malawi produces a significant amount of gold, though serious attention from the authorities has only begun in recent years. To fully unlock this potential, the country must boost support for Artisanal and Small-Scale Miners (ASMs) the backbone of Malawi’s gold sector.

Malawi’s gold industry is dominated by ASMs, yet limited support has left most miners under-equipped and operating informally. To maximize production, promote formalization, and curb smuggling estimated to cost the country over $85 million annually,government intervention is essential.Providing access to finance, modern equipment, and technical training would increase output, encourage miners to formalize, and strengthen regulatory compliance.

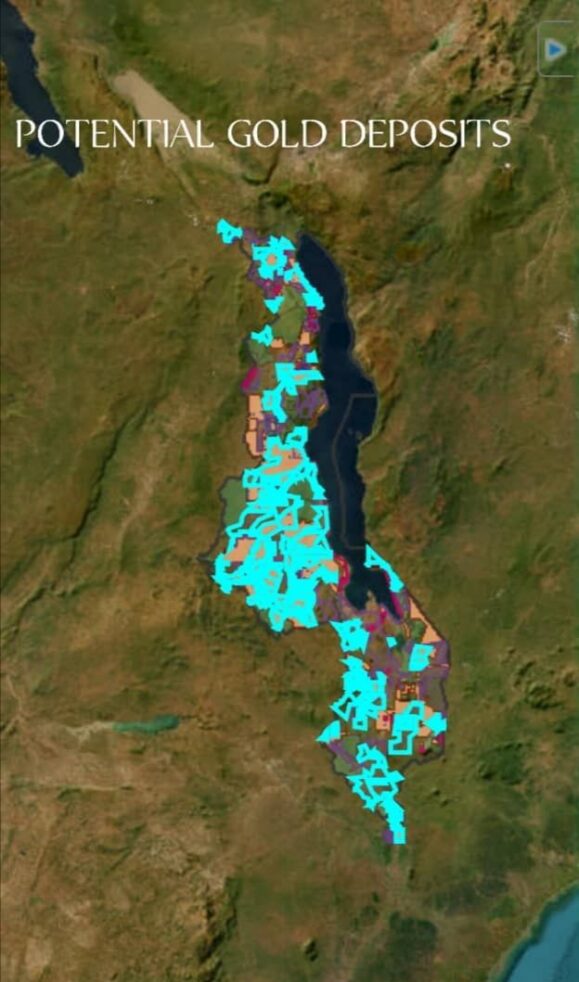

Gold is currently mined in several districts across the country, including Lilongwe, Kasungu, Mangochi, Machinga, Nkhotakota, Ntcheu, Nsanje, and Nkhata Bay, highlighting the mineral’s wide geographic spread and national economic potential.

SCALE UP BUYING AND EXPORT

The Reserve Bank Of Malawi (RBM), empowered under Section 28(b) of its Act, began buying gold through Export Development Fund(EDF) in 2021 with a target of 1.5 tons by 2025. However, only 540 kg (~$70 million) has been acquired so far.

According to RBM, its current gold stock consists of assayed gold bars processed at around 95% purity, with plans to refine them to the monetary gold standard of 99.9%.

EDF has also significantly increased its gold purchases in 2025. It is important to monitor how this affects miners including whether EDF provides any technical, financial, or capacity-building support to gold dealers and miners participating in its program. To enhance accountability and generate additional revenue, the government could require all gold dealers and miners trading with EDF to hold a PPDA certificate, as is standard for other government suppliers.

While building national gold reserves is important for long-term stability, Malawi’s immediate priority should be maximizing gold exports.

For example, the country could plan to start exporting gold from the first quarter of 2026 at around 100 kg per month, with the target reviewed every six months. Achieving this level of verified exports worth over $10 million monthly would strengthen forex reserves, stabilize the kwacha, support essential imports, and stimulate economic growth.

EDF/RBM BUYING STRATEGY — KEY RISKS AND THE NEED FOR INTERNATIONAL STANDARDS

EDF is currently buying gold at about MK400,000/gram, far above the international price, making Malawi one of the highest gold buyers in the world. The current gold price is around $4,054.88 per ounce or $130.35 per gram, as of November 23,2025. Experts warn this could lead to major financial losses, market distortion, strain on forex reserves, and attract smuggled gold from neighboring countries.

For EDF and RBM to operate efficiently, they must be guided by international standards set by the World Gold Council, World Jewellery Confederation – (CIBJO) and Responsible Jewellery Council (RJC).

Alignment with these standards is critical as it improves transparency, strengthens governance, builds investor confidence, prevents market abuse, and ensures Malawi’s gold meets global credibility and competitiveness benchmarks.

STRENGTHEN GOLD AUTHENTICATION

Fast-track the procurement of an Independent gold Assessor, as advertised in January /February and re-advertised with reference RBM/FM/01/25.

The goal is to ensure transparency, verify the authenticity and weight of purchased gold, and align with best practices.With rumors of over 50kg of counterfeit gold bought by EDF in 2023, this step is urgent. Proposals were due by April 15, 2025, but it’s been over 7 months with no public update time to push for progress and transparency.

Given the limited number of local gold experts, Malawi Government should invest in training and capacity building, leveraging international partnerships to equip professionals with skills in gold authentication, grading, and market standards

ESTABLISH LOCAL PROCESSING

The RBM and EDF in collaboration with Department of Mines , Mining and Minerals Regulatory Authority (MMRA) and MAMICO should set up a local gold processing and refining plant, or partner with established regional refineries in Southern Africa. While the RBM has been buying gold since 2021, the absence of a clear refining strategy remains a concern.

Recently, through spokesperson Boston Maliketi Banda, RBM noted: “Meanwhile, we are exploring refining options within the region… We do not know of a gold refinery that would purify the purchased gold to monetary gold standard.”

It is time to move beyond exploration. Establishing a local refining facility would add value to Malawi’s gold, reduce export costs, and enhance transparency in the sector. Beyond financial benefits, local processing would create skilled and semi-skilled job opportunities, promote technical capacity development, and stimulate ancillary industries such as logistics, security, and equipment maintenance. A domestic gold refinery would also strengthen the entire value chain, ensuring that Malawi captures a larger share of the revenue from its natural resources.

IMPROVE TRANSPARENCY AND REPORTING

Malawi should strengthen the collection and publication of accurate gold production, export, and pricing data. Clear and verified statistics build investor confidence, support responsible mining, deter smuggling, and ensure fair market practices. To operate efficiently and gain credibility in global markets, the sector must adopt international standards, aligning with bodies such as the World Gold Council, CIBJO, and RJC, which further enhance transparency, governance, and competitiveness.

LEARN FROM NEIGHBORS

Malawi can learn from neighboring countries such as Zimbabwe, Tanzania, Zambia, and Mozambique, which are generating billions of dollars annually from gold, most of which is mined by artisanal and small-scale miners (ASMs). Adopting best practices in policies, training, and traceability systems for both gold and gemstones would help Malawi compete regionally and maximize its mineral wealth.

CONCLUSION

Malawi’s gold sector holds immense potential, but much of it remains untapped due to limited support for artisanal miners, underdeveloped infrastructure, and gaps in governance and market regulation.

By boosting ASM support, strengthening authentication, scaling exports, establishing local processing, improving transparency, and aligning with international standards, Malawi can transform its gold industry into a significant driver of economic growth.

Learning from neighboring countries and adopting global best practices will ensure that gold mining benefits both the national economy and local communities. The path is clear,addressing these challenges can unlock Malawi’s gold wealth and secure a more prosperous future.