By Burnett Munthali

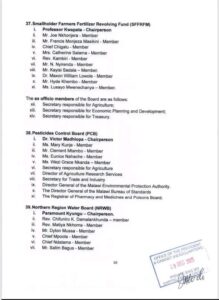

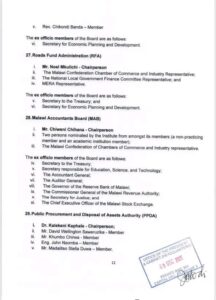

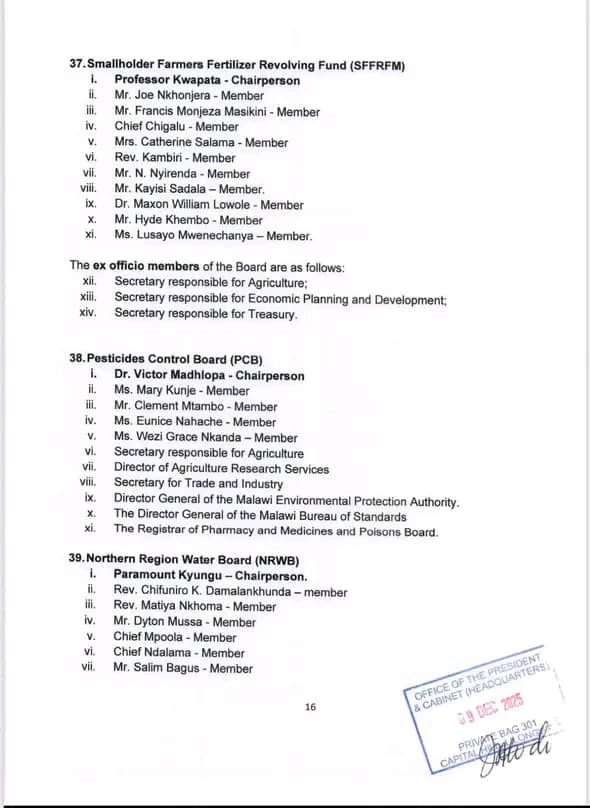

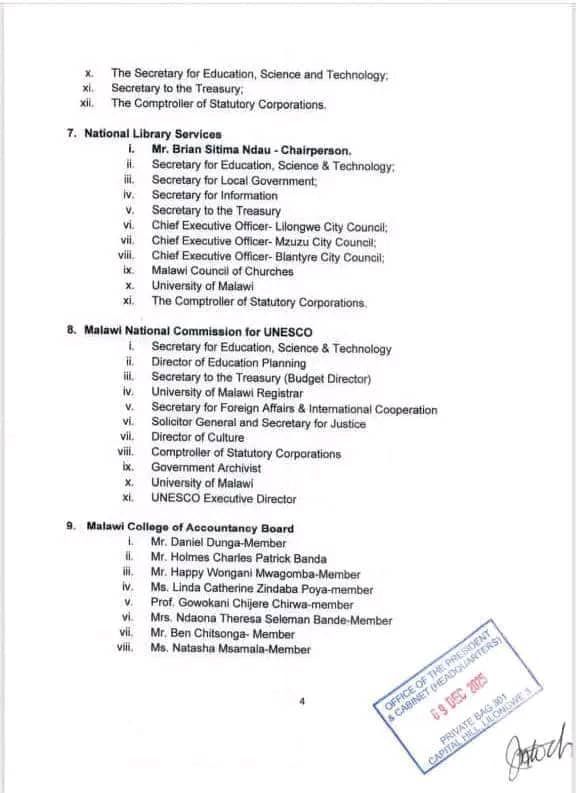

Government has announced a sweeping reconstitution of Boards of Directors for 66 State-Owned Enterprises and Statutory Corporations across vital sectors of the national economy.

The appointments, which became effective on 9th December 2025, cover institutions operating under the Ministries of Education, Youth and Sports, Information, Lands, Labour, Finance, Agriculture, Transport, Natural Resources, Industry, and Gender.

According to a press release signed by the Chief Secretary, Dr Justin Adack K. Saidi, the newly appointed boards are expected to provide “sound strategic guidance and robust oversight.”

The statement emphasised that the restructuring is intended to enhance the performance of public institutions and strengthen accountability in the management of public resources.

Government said the new boards will be central in improving the delivery of essential public services to Malawians, particularly in sectors that directly impact national development.

Key appointments include new boards for the Malawi Broadcasting Corporation (MBC), Electricity Supply Corporation of Malawi (ESCOM), and the National Food Reserve Agency (NFRA).

Other major institutions such as the Roads Authority, the Malawi Housing Corporation, and all public universities are also part of the extensive reconstitution.

The government stressed that board members were selected based on merit, expertise, and the need to ensure balanced representation across sectors.

It further stated that the revamp reflects an ongoing commitment to reforming public institutions to improve efficiency and service delivery.

The restructuring marks one of the largest governance overhauls in recent years, signalling government’s determination to strengthen state corporations and accelerate national development.